Sales Tax Penalty Waiver Sample Letter / 9+ Tax Penalty Waiver Letter Sample | Nurul Amal

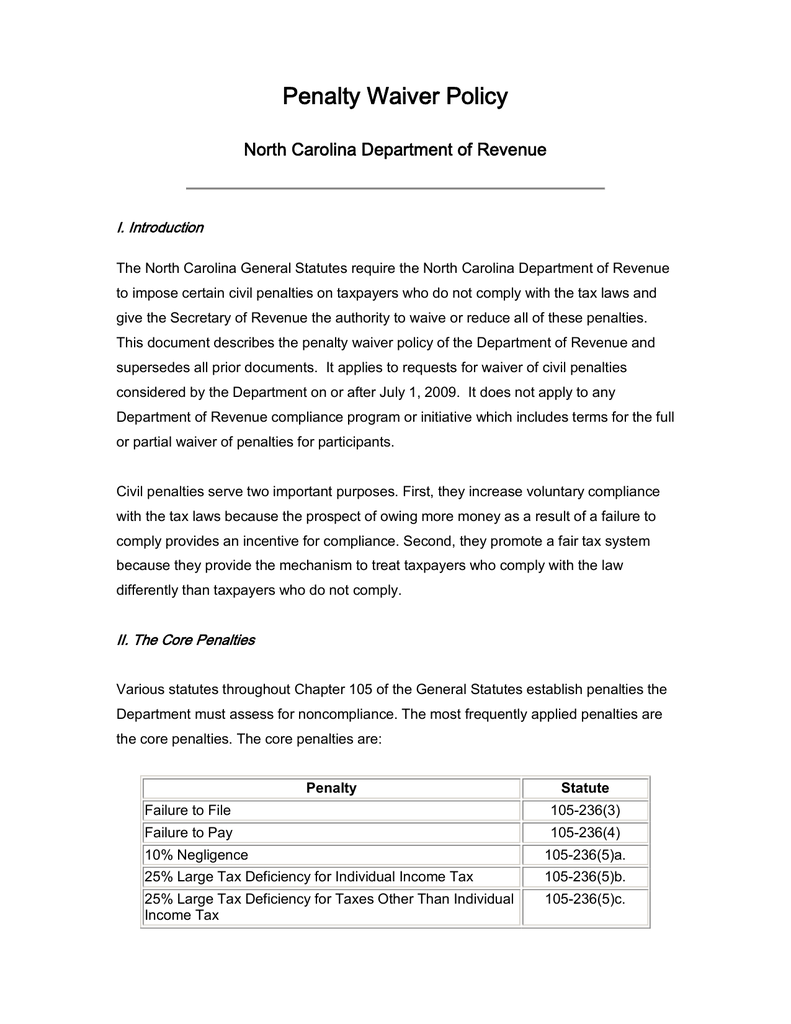

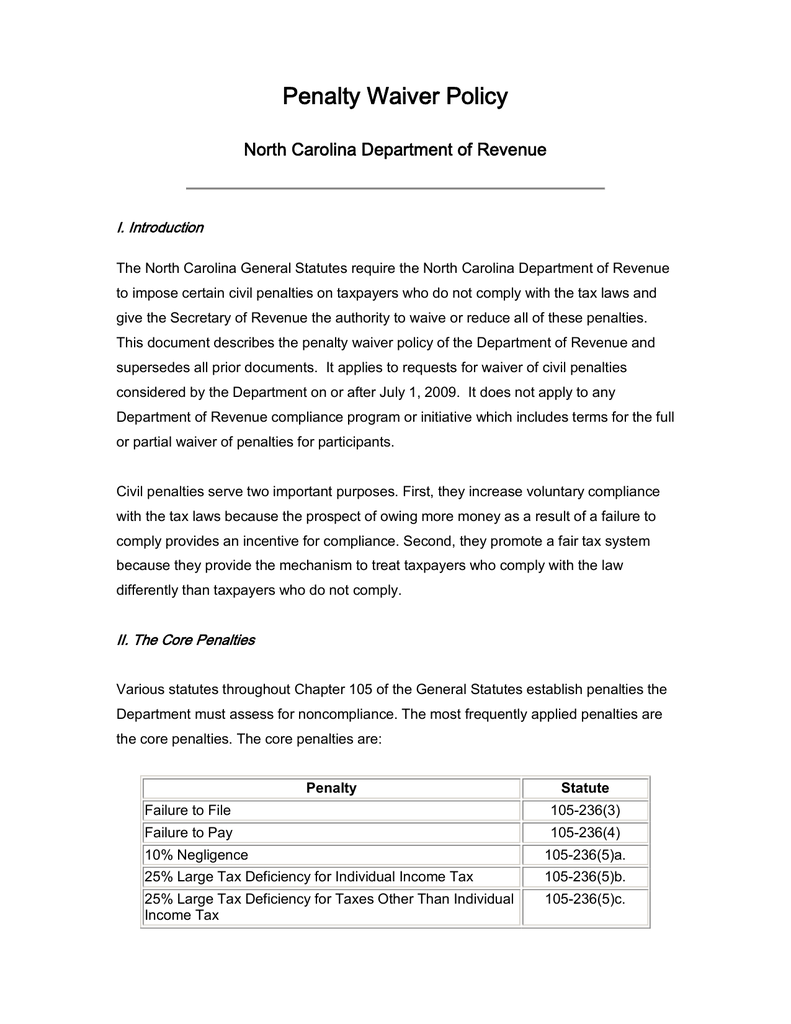

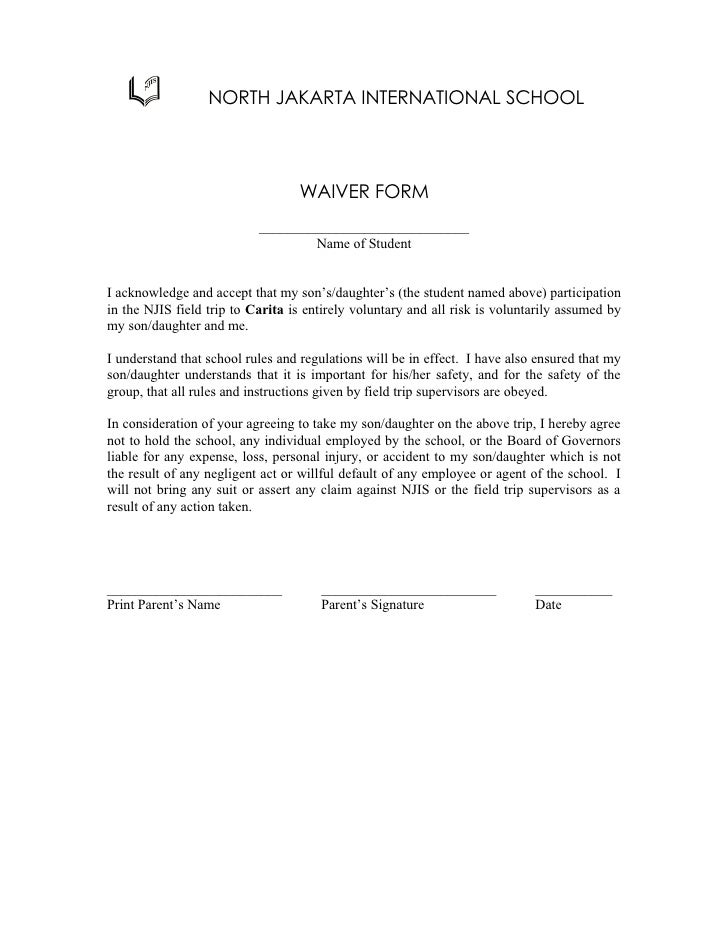

After you find out all sales tax penalty waiver letter results you wish, you will have many options to find the best saving by clicking to the button get link coupon or more offers of the store on the right to see all the related coupon, promote. The waiver letter or waiver agreement is a document that confirms that a party has surrendered or waived their rights. 50 proof of funds letter. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty always ask the merchant if a surcharge applies when requesting cash back at the point of sale. It is super easy method to perfect the skills of writing letters. Kra waiver processing is a structured process that needs to be validated by an officer before the waiver is.

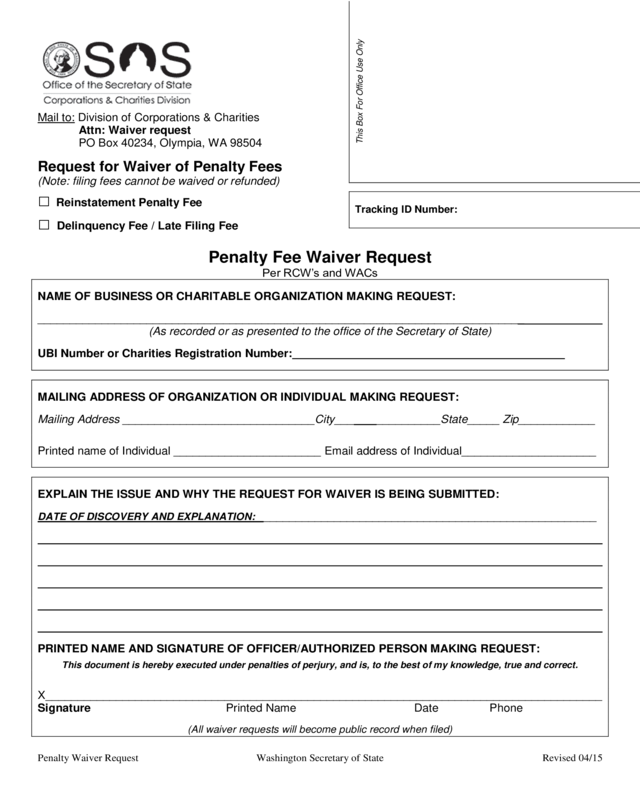

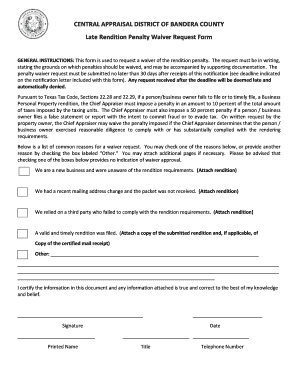

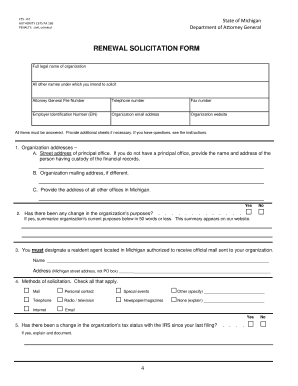

Penalty waiver request letter sample source. Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for late filing of returns to upload your kra waiver letter under the upload section. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty always ask the merchant if a surcharge applies when requesting cash back at the point of sale. Home»free templates»sample letter»9+ tax penalty waiver letter sample. Standard tender document for sale of disposable stores and equipment. Copyright i am hereby writing this letter requesting your humble office for waiver on the above penalty. How do i know if my return is on time? Your request will be denied, if supporting documentation is not provided for reasons number 3 through 13. Use success tax relief's irs penalty abatement sample letter to get you started. Search for another form here.

Request to waived for penalty ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample.

Sample format of letter to waive penalty. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be. It is super easy method to perfect the skills of writing letters. Sample format for sales tax letter. Here is a sample letter to request irs penalty abatement. You may also contact us to request a penalty waiver by mailing a letter or sending a secure message. Waiver requests for late reports and payments. Sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay your federal taxes details: If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty always ask the merchant if a surcharge applies when requesting cash back at the point of sale. Copyright i am hereby writing this letter requesting your humble office for waiver on the above penalty. Sample penalty abatement letter to irs to waive tax penalties. This document is used when a party decides to give up their rights or claim to relieve the other party from liability.

You can use this template as a guide to help you write a letter. There are two ways to apply for penalty abatement. Fill new jersey penalty abatement: For example, a party to a contract may surrender its right to claim. Request letter for insurance penalty charges waiver… request letter to landlord regarding late rent payment. Waiver requests for late reports and payments. Kra waiver processing is a structured process that needs to be validated by an officer before the waiver is. However writing a letter of waiver isnt a 100 percent guarantee that the other party will comply. Sample format of letter to waive penalty.

Copyright i am hereby writing this letter requesting your humble office for waiver on the above penalty.

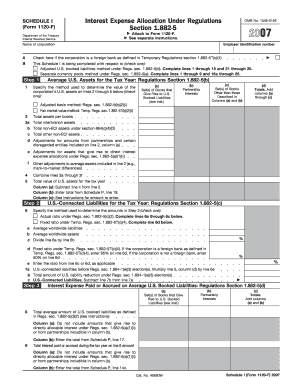

Sample letter to irs to waive penalty is not the form you're looking for? Search for another form here. For example, if someone was thinking about going hunting on a gaming reserve, they may have to sign a letter of waiver that states that the owner of. You can either draft a letter and send it, or call the irs and talk to one of their agents we recommend sending a letter so that you have a paper trail and documentation. Standard tender document for sale of disposable stores and equipment. Sales sales tax tax tax tax tax tax tax sales• generally, the tax shall be computed at 5.3%, with one half cent or more being treated as one cent. Waiver requests for late reports and payments. Sample request letter format for considering two or more companies together as group companies for commercial purpose (discounts, credit lim. Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for late filing of returns to upload your kra waiver letter under the upload section. Letter requesting to waive late fee payment penalty. However writing a letter of waiver isnt a 100 percent guarantee that the other party will comply. There are two ways to apply for penalty abatement. Irs penalty waiver letter sample page 1 line 17qq com first time penalty abatement from irs with sample letter tax resolution.

Sales tax penalty waiver letter sample related files All access to sales tax penalty waiver letter sample pdf. Letter requesting to waive late fee payment penalty. Searching summary for sales tax penalty waiver letter. Penalties may be granted under section. We've got suggestions in order to help you reveal your best self and a sample you and also, scroll to see an example cover letter you could make use of to craft your very own. For example, a party to a contract may surrender its right to claim. You requested a penalty waiver or abatement.

Irs penalty waiver letter sample page 1 line 17qq com first time penalty abatement from irs with sample letter tax resolution.

Attach additional documentation to support your reason(s) for requesting a penalty waiver. After you find out all sales tax penalty waiver letter results you wish, you will have many options to find the best saving by clicking to the button get link coupon or more offers of the store on the right to see all the related coupon, promote. We are writing to request that her penalty for filing irs reasonable cause letter sample. It is super easy method to perfect the skills of writing letters. Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for late filing of returns to upload your kra waiver letter under the upload section. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Sales sales tax tax tax tax tax tax tax sales• generally, the tax shall be computed at 5.3%, with one half cent or more being treated as one cent. Search for another form here. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Here is a sample letter to request irs penalty abatement. Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for the late filing of returns to be removed or simple terms waived. This document is used when a party decides to give up their rights or claim to relieve the other party from liability.

Sales & use tax rates.

For example, if someone was thinking about going hunting on a gaming reserve, they may have to sign a letter of waiver that states that the owner of.

After you find out all sales tax penalty waiver letter results you wish, you will have many options to find the best saving by clicking to the button get link coupon or more offers of the store on the right to see all the related coupon, promote.

There are two ways to apply for penalty abatement.

Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for the late filing of returns to be removed or simple terms waived.

Sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay your federal taxes details:

Many tasks ask you to file a cover letter along with your other application products, but even if a cover letter is optional, you might take the chance to send one along.

Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for the late filing of returns to be removed or simple terms waived.

Sales tax for the period(s) hh you must include a detailed explanation with your offer in compromise.

All access to sales tax penalty waiver letter sample pdf.

Kra waiver processing is a structured process that needs to be validated by an officer before the waiver is.

Request to waived for penalty ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample.

Waiver requests for late reports and payments.

Moreover some individuals uses internet resources for sample letters to get at learn about the particular and particular format for letter.

/Penalty_Abatement_Letter_293x382.png?width=520&height=345&name=Penalty_Abatement_Letter_293x382.png)

For a request for waiver of penalty, explain the circumstances that prevented timely filing and/or payment and provide copies of supporting documentation of special circumstances, such as medical.

Sample request letter format for considering two or more companies together as group companies for commercial purpose (discounts, credit lim.

Penalty waiver request letter sample source:

It is super easy method to perfect the skills of writing letters.

Having a hard time to compose a cover letter that will catch a company's focus?

Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for the late filing of returns to be removed or simple terms waived.

Sales & use tax rates.

Sample template example of property & bank loan documents hand over letter format after full payment of loan & asking for receipt a.

Sample request letter for penalty wiaver.

Request for waiver of late subcharge of tax.

It is super easy method to perfect the skills of writing letters.

This document is used when a party decides to give up their rights or claim to relieve the other party from liability.

Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for late filing of returns to upload your kra waiver letter under the upload section.

Proceed to select 'tax obligation (income tax resident individual)' and then select the 'tax.

Penalty waiver request letter sample source.

.png)